Long-term value is created by serving the best interests of all stakeholders in a company’s ecosystem.

Responsible Investment

A holistic assessment enables our teams to take a long-term view of investments

Megatrends such as corporate governance reforms, the energy transition, climate change hazards and the transition to a reduced-carbon economy can have significant financial impacts on investment portfolios. As an investment manager, SeaTown believes that successful integration of these factors in analyses and decisions across the investment lifecycle improves long-term outcomes.

Consistent with our fiduciary responsibilities, SeaTown recognizes our obligation to act in the best interests of clients through our deep understanding of global shifts.

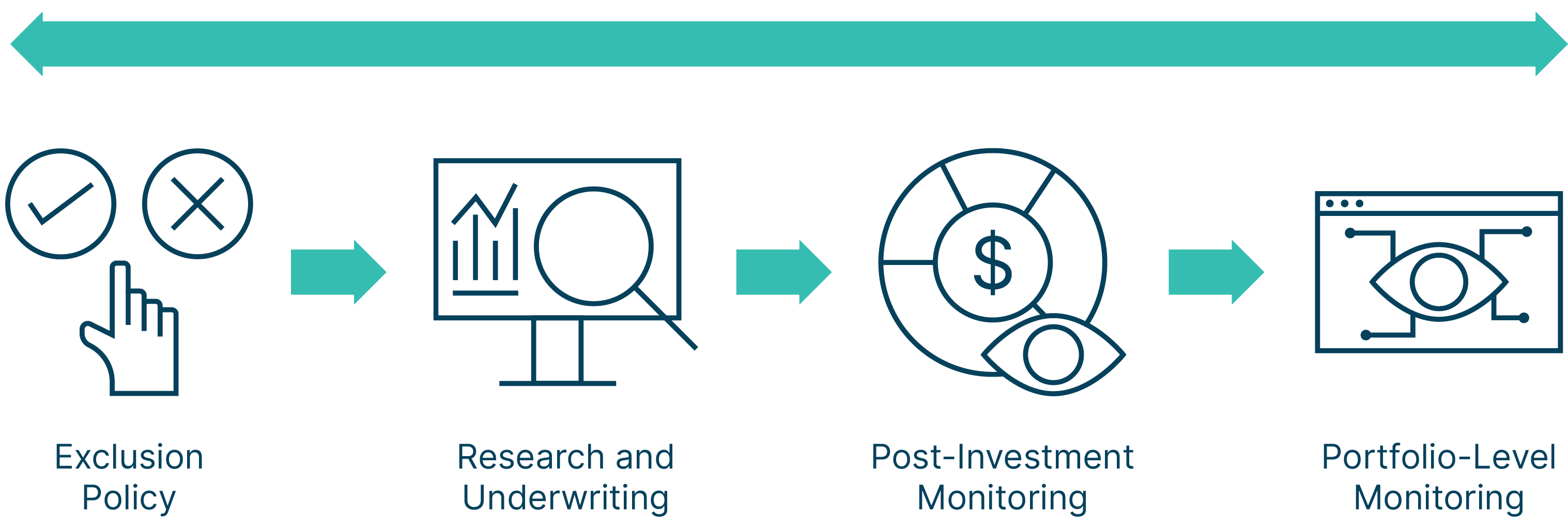

Responsible investment processes are integrated across our investment lifecycle

Responsible investment considerations are integrated throughout the investment process for our equity and debt investments, and are subject to relevant policies and processes.

SeaTown has developed a proprietary tool which is used to assess financially material risks. The tool provides our analysts with data on a company’s carbon emissions and carbon price earnings sensitivity.

The tool also highlights relevant financially material topics based on SASB’s sector-specific guidance. Investment teams assess companies on their carbon emissions and potential financial impact from carbon pricing, as well as assess material topics. Governance is also a required topic to be assessed for all investments.