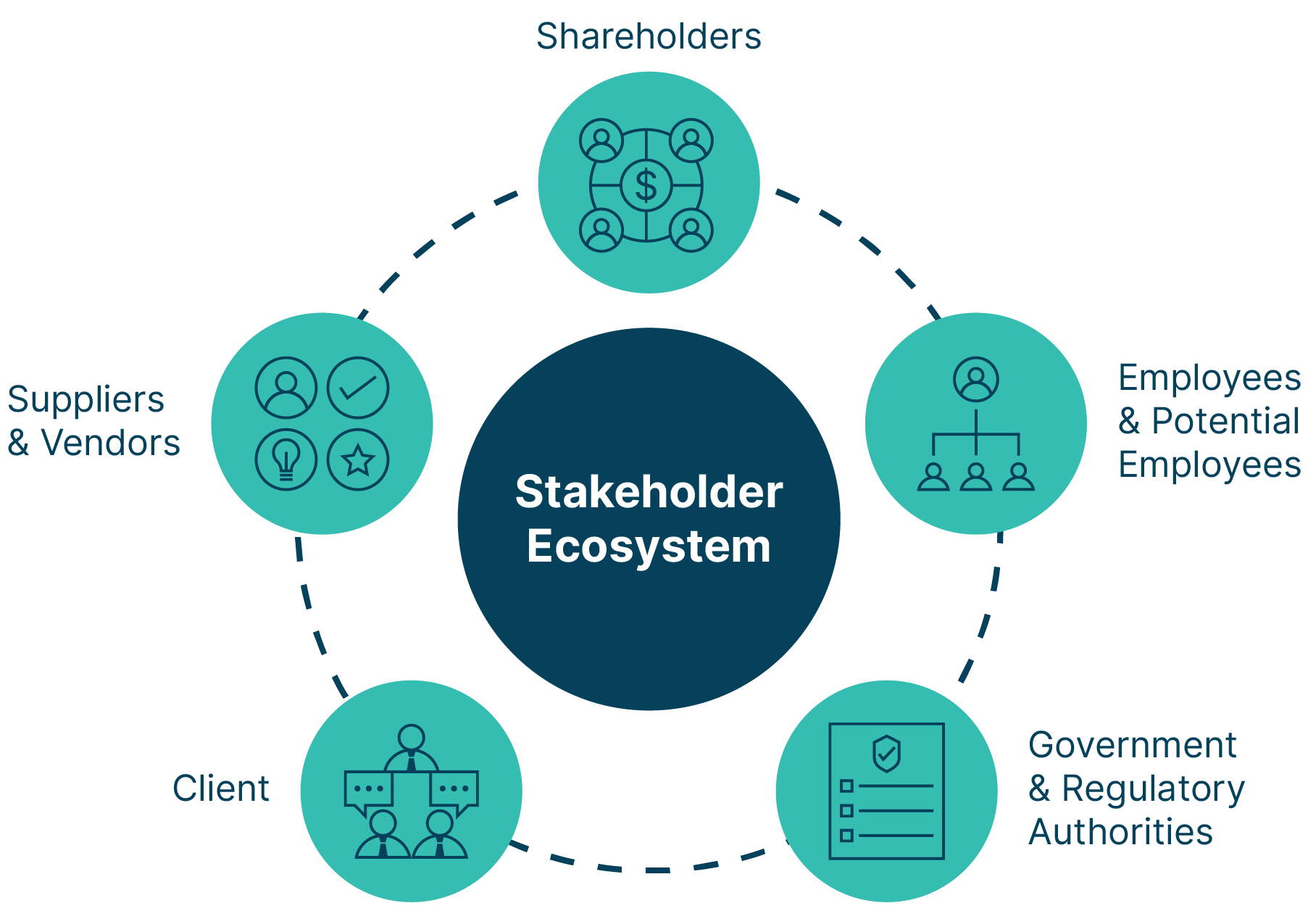

Long-term value is created by serving the best interests of all stakeholders in a company’s ecosystem.

ESG Integration (Investments)

A holistic ESG assessment enables our teams to take a long-term view of investments

We believe that long-term value is created by serving the best interests of all stakeholders in a company’s ecosystem.

Companies that serve their stakeholders are environmentally responsible, have strong governance and compliance practices, and value human capital in their operations as well as in their value chain. These companies will be best positioned to manage the shocks of a volatile world, comply with tightening regulations, and thrive financially. In the long-term, shareholder and stakeholder interests are aligned.

In our ESG assessment process, we examine a company’s relationship with stakeholders throughout their ecosystem. The SASB and TCFD frameworks guide our teams to identify and evaluate material issues, key risks and areas for engagement.

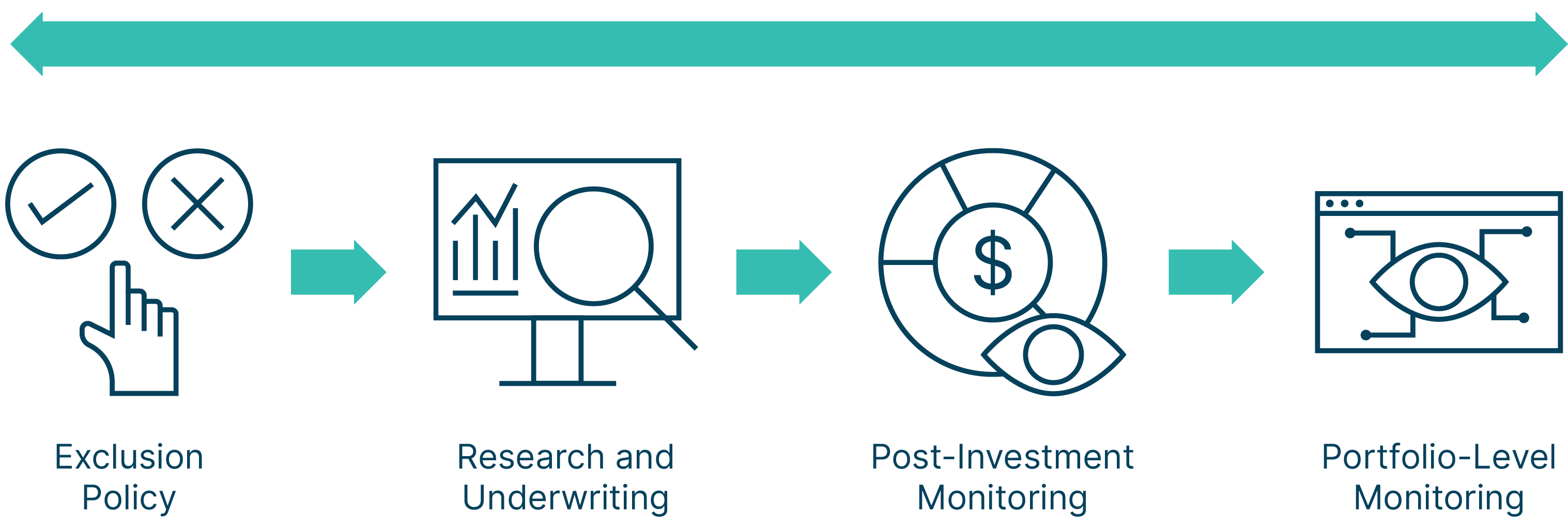

ESG assessment is integrated across our investment process

By integrating ESG assessment across the investment approval process, SeaTown ensures that ESG risks and opportunities are considered in the underwriting process, including active discussion at Investment Committee meetings with the ESG Team.

Our teams are guided by and contribute to international standards such as SASB and TCFD. Companies are assessed on their carbon footprint and potential financial impact from carbon pricing. In addition, all material ESG issues as determined by sector-specific SASB standards and the quality of governance are evaluated for all investments.

To empower investment teams to make informed ESG assessments, SeaTown has developed proprietary ESG assessment tools in addition to procuring third-party ESG resources.

Exclusion Policy

- Certain controversial industries are restricted from investment

Research & Underwriting

- Investments are assessed for ESG risk and opportunity under the SASB and TCFD frameworks

- Address identified ESG risks sufficiently

- Carbon price earnings sensitivity analysis is conducted

- Independent ESG Team vets ESG issues at Investment Committee meetings

Post-Investment Monitoring

- Key risk areas identified in the ESG assessment are monitored on an ongoing basis

Portfolio-level Monitoring

- Our carbon footprint is monitored on a portfolio level

Investing in the transition towards a sustainable world

SeaTown monitors the climate metrics of companies in our portfolio (such as Weighted Average Carbon Intensity and Apportioned Emissions) for each of SeaTown’s funds. Portfolio-level scenario analysis is also performed to assess the resilience of our portfolio to transitional climate risks. This allows us to maintain oversight of our climate risks, identify potential losses, and take early mitigating action if needed. Regular monitoring will also allow us to highlight climate risks in portfolio companies in order to drive engagement. It is our responsibility to exercise thoughtful stewardship to safeguard the long-term value of our investments.